Merger and acquisition activity in the semiconductor and electronics supply chain was a highlight of 2025. Synopsys (SNPS) got its mega-takeover of ANSYS across the finish line. Apple (AAPL) suppliers Skyworks Solutions (SWKS) and Qorvo (QRVO) announced their intent to merge. Softbank (SFTBY) purchased chip design startup Ampere Computing, including the stake in Ampere owned by Oracle (ORCL). And all of this doesn’t count the sizable deals in the downstream software and other markets.

But let’s focus on another acquisition strategist, Amphenol (APH), which has been gobbling up parts of struggling manufacturer CommScope Holding (COMM) piecemeal this year. This will be a significant deal when we discuss the AI data center and optical networking industry deep dive later this week. Catch the whole thing on Chip Stock Investor (CSI) Live this Wednesday, December 17th: chipstockinvestor.com/membership/.

The following is an update on Amphenol for CSI Semiconductor Insider a couple months ago.

Amphenol has been hot in 2025, is it part of the AI hardware bubble?

The TL;DR of this update: We’re simply going to re-affirm our view that Amphenol is a great long-term compounder for investors in need of a broad manufacturing business portfolio holding.

But stick around, we want to get more nuanced after the Q3 2025 update. Because some might argue that Amphenol is simply another bubble stock, flying unsustainably higher because of the fast pace of AI data center buildout.

Check out Fiscal.ai/csi to get 15% off any paid plan! Make financial visuals to get a better understanding of the businesses you invest in.

Amphenol participates in much more than data center construction

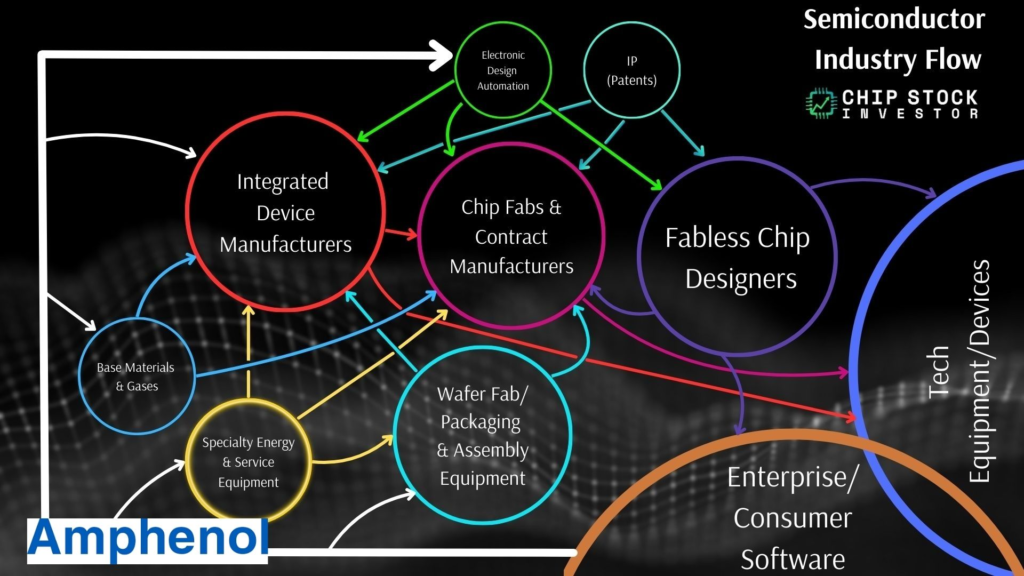

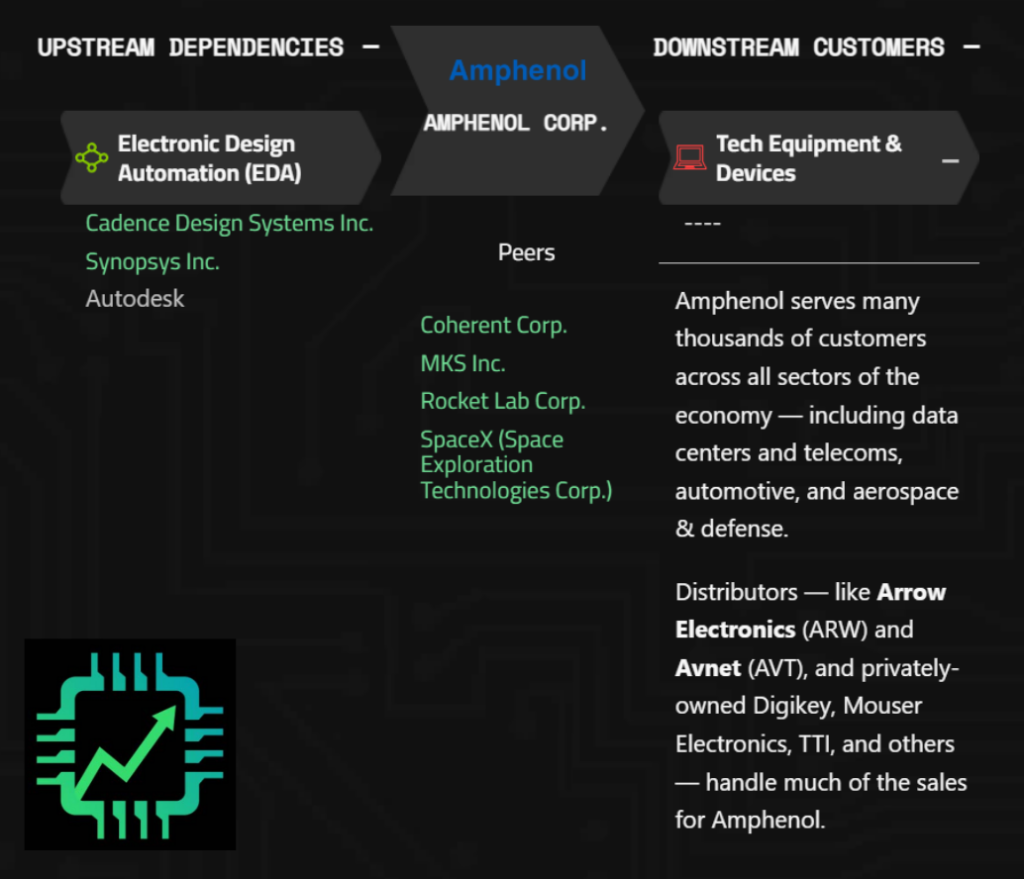

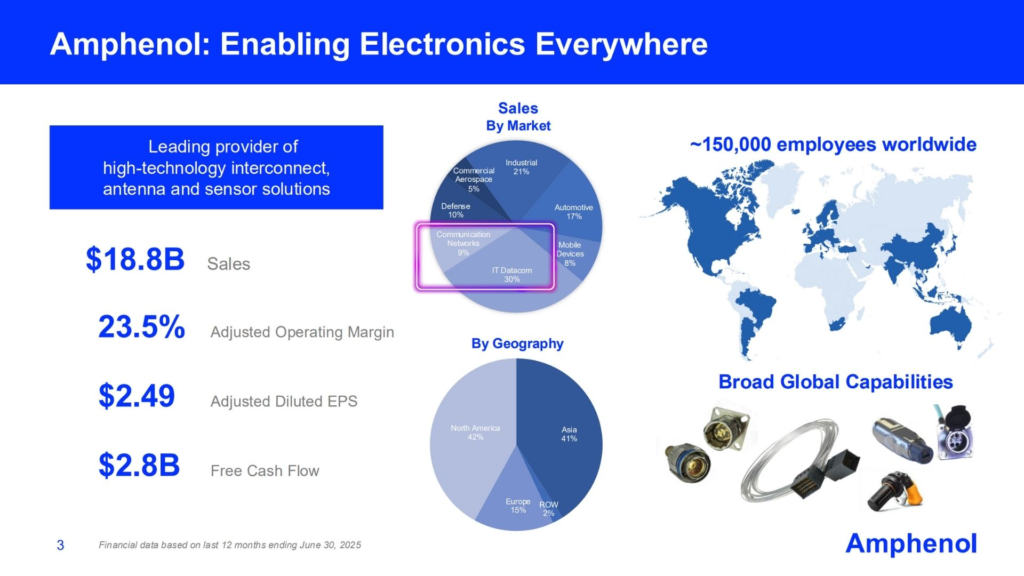

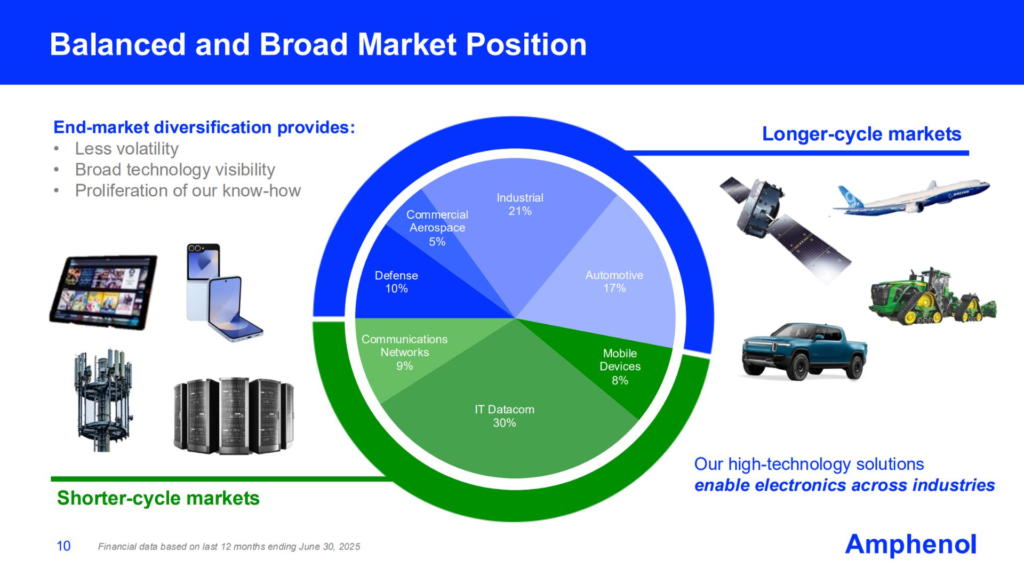

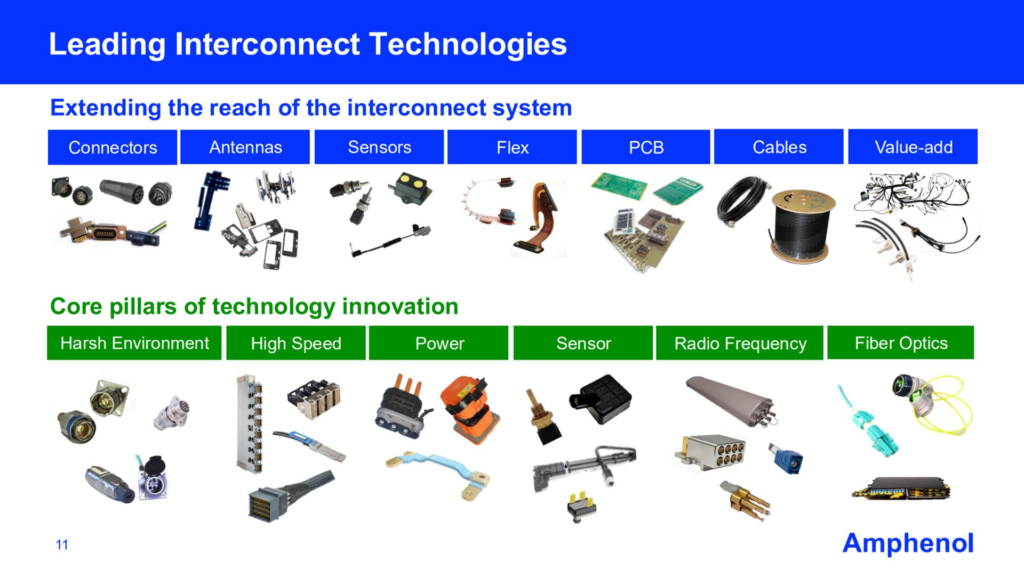

We file Amphenol under the specialty equipment portion of the broader electronics manufacturing supply chain. APH’s offerings are incredibly broad, covering all sorts of basic connectivity parts and pieces, printed circuit board manufacturing, and sensors.

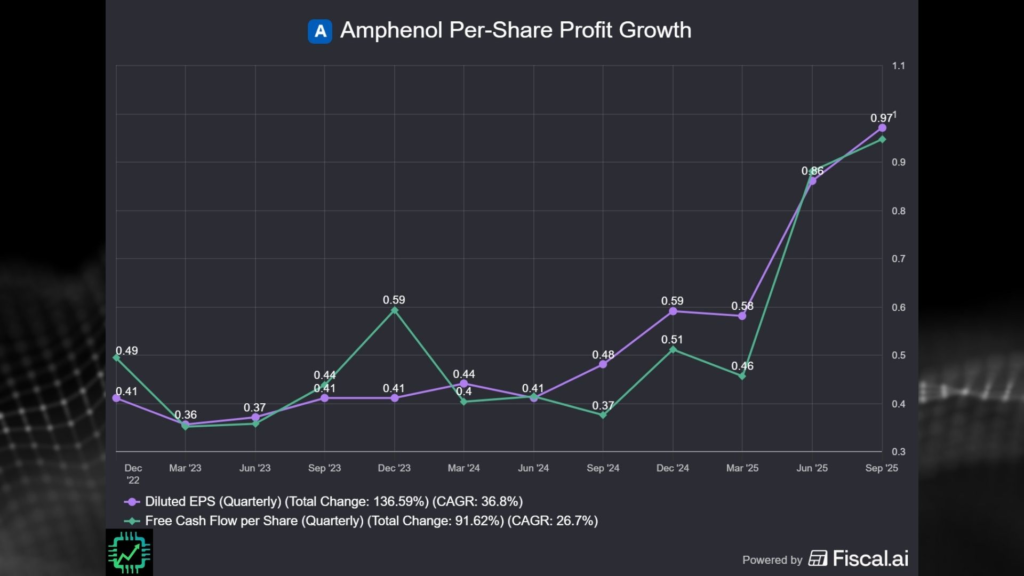

Yes, we must acknowledge that the current frenzied pace of AI data center construction does account for a lot of APH’s current revenue surge. Management reported 53% revenue growth in Q3 2025, or 41% “organic” growth (which excludes the effect of acquisitions, like the portion of CommScope acquired back in February).

Per-share profit growth, both on a GAAP basis and free cash flow (FCF) basis also soared thanks to the organic sales and acquisitions.

However, let’s not underestimate Amphenol’s participation in other industries outside of data centers (IT datacom is only about one-third of total sales). The communications market — from internet service providers to small regional and local business network builders alike, which puts APH in competition with parts of Ubiquiti (UI) — is also rallying. And Amphenol is also delivering in areas like automotive, and aerospace & defense.

Key to the business’ success outside of data centers is integration of acquisitions, and then boosting profitability once those new assets are acquired. Like the aforementioned purchase of CommScope’s outdoor wireless and antenna business early this year, which added not just a big chunk of new non-organic sales, but was also accretive to profitability in Q3. A small manufacturer in Texas called Rochester Sensors, which makes sensors for industrial liquids, was also added to the portfolio in Q3. Amphenol’s broad manufacturing footprint and complementary products allows it to unlock cost synergy and cross-sell to existing customers when it makes a new purchase like it has earlier this year.

The same template of acquire-and-expand is on repeat with a string of acquisitions announced a couple of months ago. Another purchase from struggling CommScope will further expand Amphenol’s data center and IT communications connectivity and cable business, and small privately-owned Trexon will get added to the aerospace & defense category.

Valuation notes

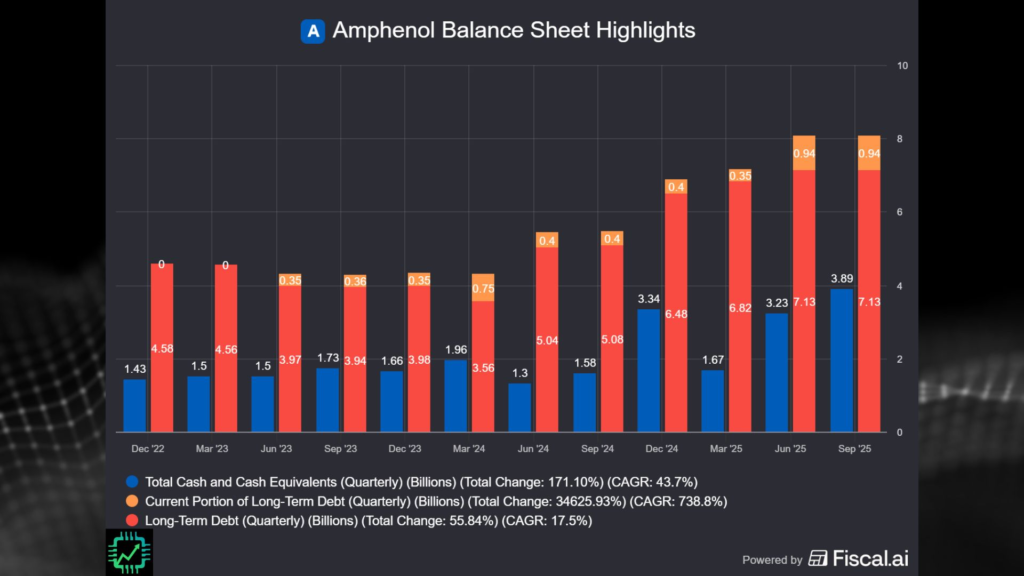

Beyond the booming data center business, there is also (rightfully) some concern about the balance sheet. Amphenol’s private equity-style management of manufacturing businesses has ratcheted up debt on the balance sheet (just shy of $4 billion in cash, just over $8 billion in debt as of the end of September 2025). The net debt situation will worsen, as the latest CommScope purchase will cost $10.5 billion, and Trexon $1 billion.

With debt likely to jump towards $20 billion in early 2026, we would expect a period of debt paydown to follow, especially once CommScope CCS is purchased in Q1 2026. But given Amphenol’s momentum in generating much higher profit as of late, this paydown period and de-leveraging could play out quickly.

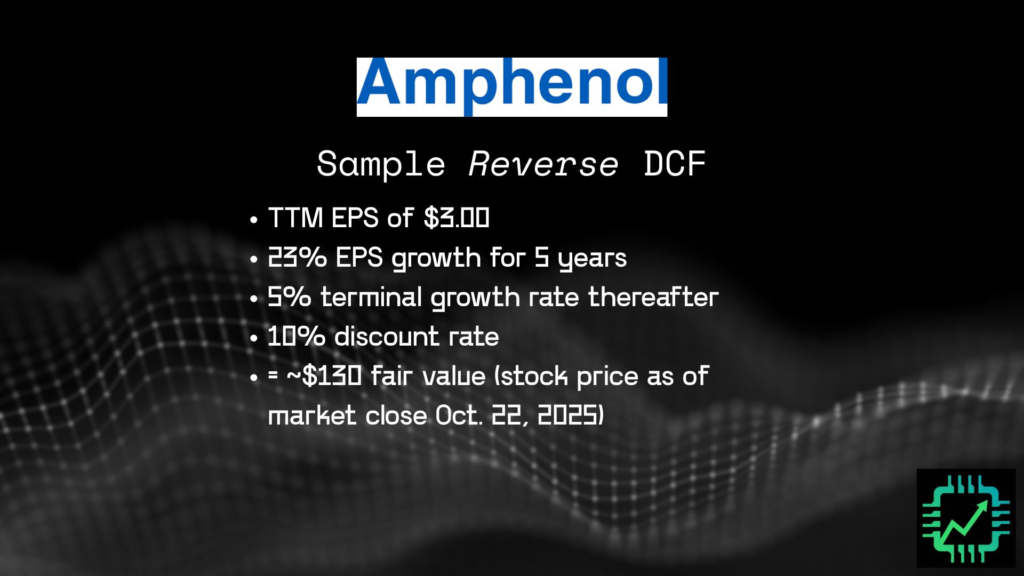

Despite the stock more than doubling again in 2025, and with organic and acquisition-driven profit carrying into 2026, APH actually still appears to be somewhat reasonably priced to us at this juncture. We ran a reverse DCF to get a feel for what the market is pricing in currently ($130 per share following earnings).

- TTM EPS of $3.00

- 23% EPS growth for 5 years

- 5% terminal growth rate thereafter

- 10% discount rate

- = ~$130 fair value (stock price as of market close Dec. 15, 2025)

The 5-year EPS growth rate of 23% is elevated, but the acquisition activity alone could go a long way to covering that higher per-share profit growth. For those in need of a manufacturing business — be it for AI data center parts, or otherwise — Amphenol still checks off all our boxes, save for the high amount of debt expected in 2026. But, that debt appears manageable given Amphenol’s strengths. At the moment, we’re not seeing an “AI bubble” company.

Long live “boring” stocks. See you over on CSI Semi Insider for more!