Quite the week. Michael Burry, of The Big Short fame, has re-emerged — bearing bad news for the AI data center bulls. Burry fired up his X (fka Twitter) account to decry the extension of depreciation schedules for hyperscaler (Amazon, Alphabet, Microsoft, Meta, and Oracle) servers. An extension of a depreciation schedule assumes the asset (in this case, a lot of Nvidia (NVDA) GPU-based servers used in all things AI) has a longer lifespan of usefulness.

Burry’s argument is that this lowered depreciation expense enables a massive overstatement of GAAP earnings per share, all the while “concealing” elevated capital expenditures on GPU purchases. Is it a “fraud” as Burry claims? We’ve been promised more updates on November 25. We don’t encourage use of social media as a means of doing investment research, but at least for entertainment value… https://x.com/michaeljburry

Oh, and Burry’s hedge fund Scion management also reported large short positions in Nvidia and Palantir (PLTR) too. Burry doesn’t like journalists reporting on 13-F filings, but we aren’t journalists, so there. https://www.sec.gov/Archives/edgar/data/1649339/000164933925000007/xslForm13F_X02/infotable.xml

About the earnings over-statement “fraud”

We’ll mention here that we all at once agree and disagree with Burry’s claims.

As for the agreement part, we’ll take a look at CoreWeave (CRWV) in just a moment.

And in disagreement? Burry’s accusation of the hyperscalers use of extended depreciation schedules isn’t a new argument. Amazon extended the useful life of its AWS cloud servers in 2022, from 4 years to 5, and then again in 2024 from 5 to up to 6 years. The other hyperscalers have done the same in recent years, especially starting around 2022 and 2023, the same period in which GPU purchases from Nvidia started in earnest.

The simplest explanation for the extended useful life of these AI servers? Perhaps it isn’t for over-statement of GAAP earnings at all. Maybe, just maybe, GPU server useful lives really do last for 5 or 6 years. We’ve made this case all along, as Nvidia H100s (released in 2022) are still very much in use in data centers today for “mature” workloads. This is in spite of Nvidia and other chip designers being on a very tight new-product-release schedule every year or two.

We’ve made this case all along. When you’re a data center company generating tens of billions of dollars in revenue every quarter, there are innumerable places an older GPU server can be put in service after its done doing cutting-edge research and AI model training. The TRUTH About the AI Bubble, Alphabet GOOGL Stock, and What It Means For Nvidia

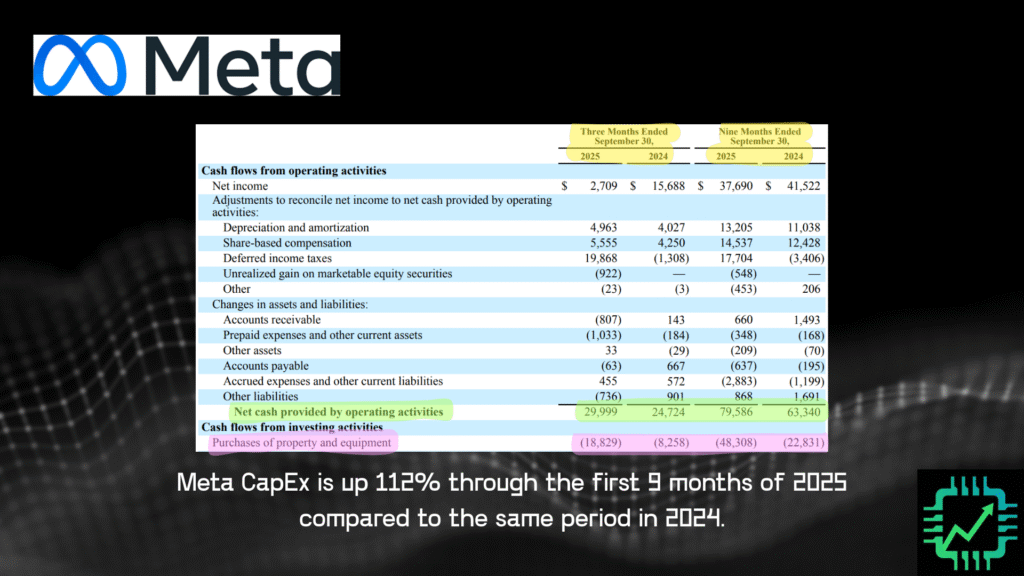

And it’s not like the hyperscalers are hiding their spending. On the contrary, investors around the globe have become hyperaware of CapEx and resulting free cash flow profitability, disclosed prominently on cash flow statements — usually super easy to find on earnings press releases themselves. For example, Meta’s Q3 2025 press release, pg. 7: https://s21.q4cdn.com/399680738/files/doc_financials/2025/q3/Meta-09-30-2025-Exhibit-99-1-Final.pdf

Concerning to see quarterly CapEx of $18.8 billion, on revenue of $51.2 billion and net cash from operating activities of $30 billion? Sure. This level of CapEx is unsustainable, and will eventually need to moderate.

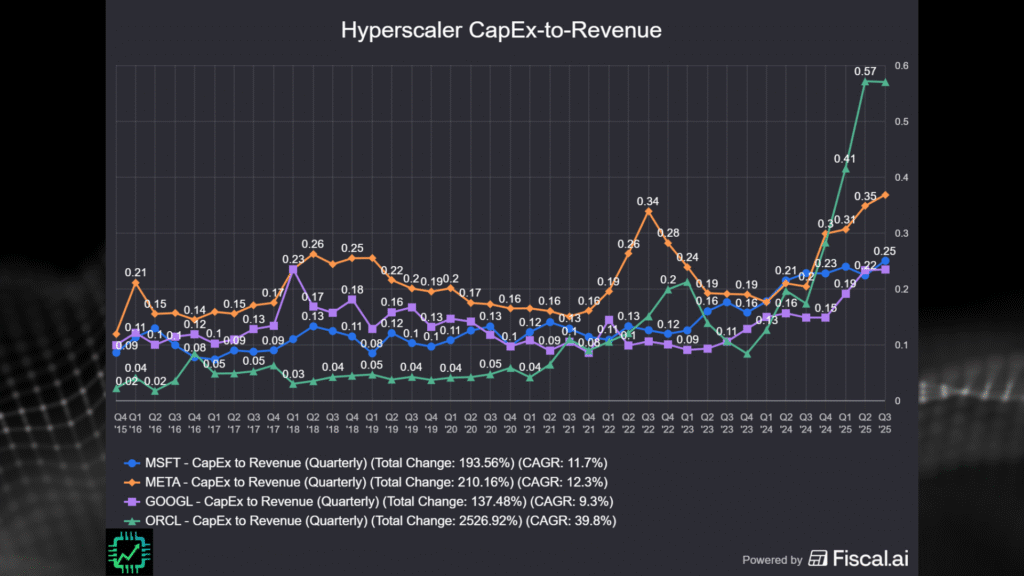

But, that’s why we call businesses reliant on hardware “cyclical.” Some years the CapEx is high, other years it’s low. When the spending is high, the market discounts the risk — via selloffs in stock prices — that the CapEx spend won’t achieve robust return on investment. Which, is what has happened to Meta’s and Oracle’s stock as of late (much higher CapEx than the other three hyperscalers, excluding Amazon since its CapEx also encompasses e-comm warehouses).

Want to make and track financial visualizations like this one? Use our link and get 15% off any paid plan, Fiscal.ai/csi!

Depreciation is an accounting profit metric. The actual cash has already been spent. Want an accurate read on real profitability, and historic trends? Check the cash flow statement, where you can calculate free cash flow, “hiding” in clear sight. Hardly what we’d call a fraud.

On the other hand, the risk is real

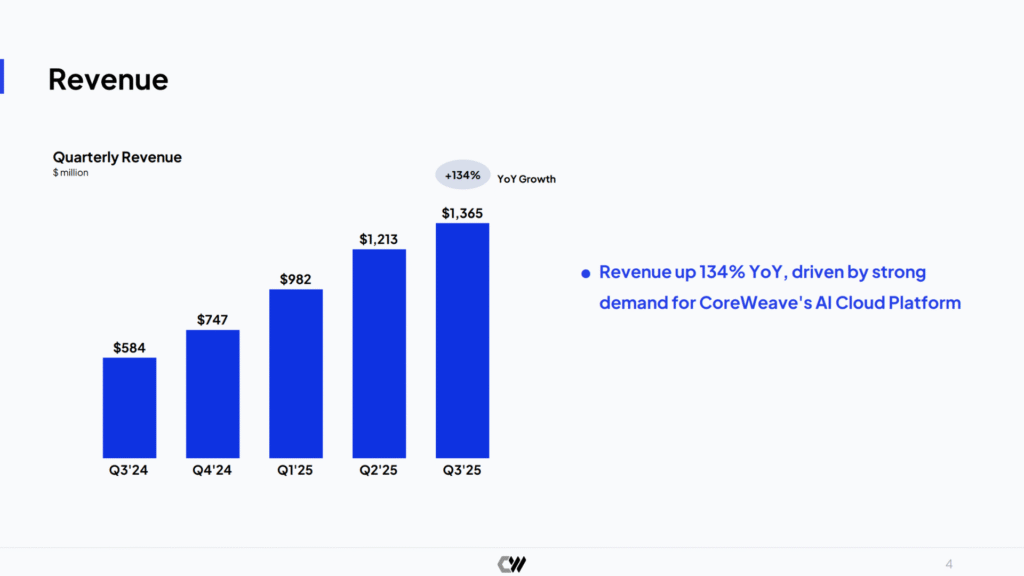

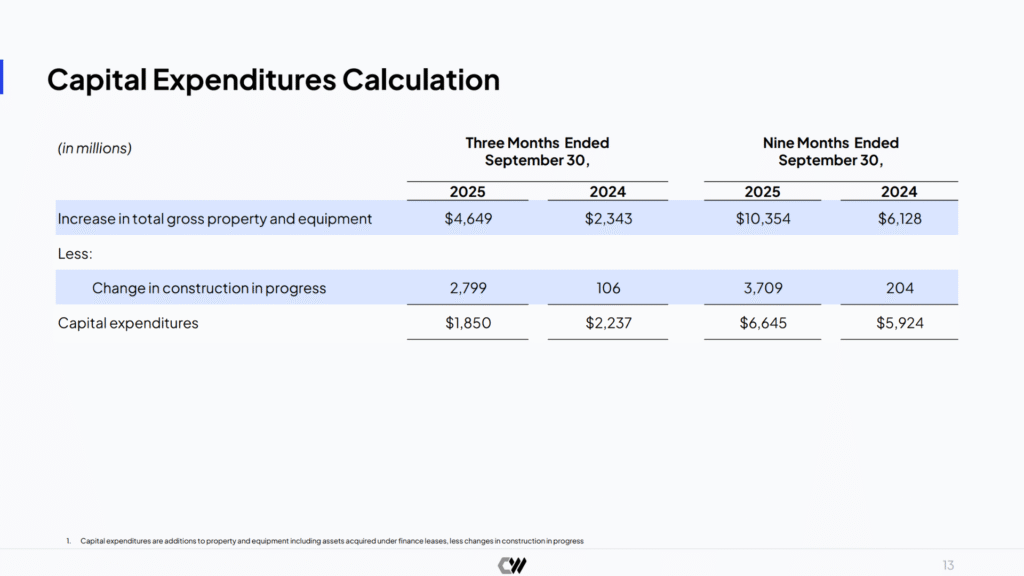

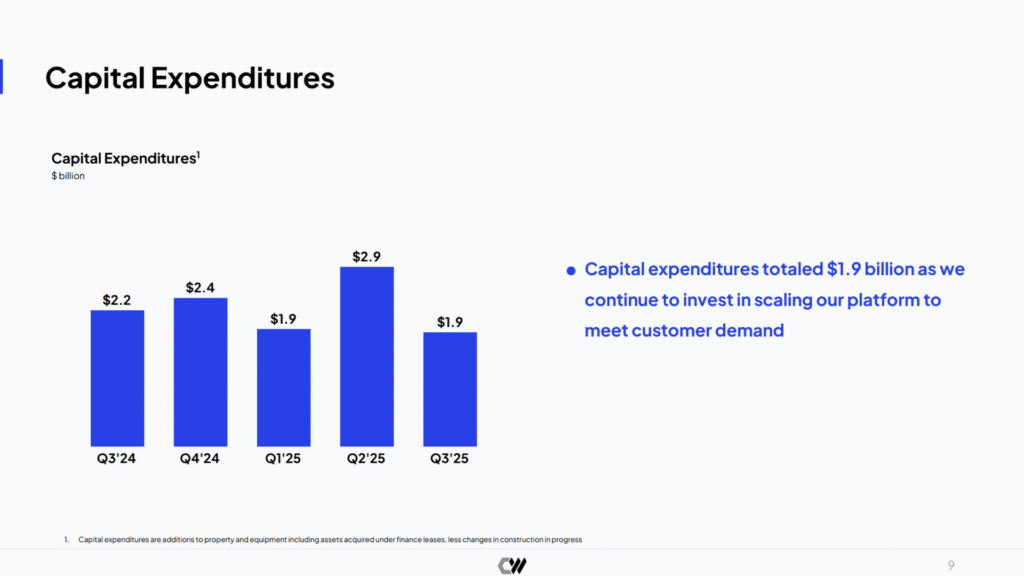

Moving on to CoreWeave Q3 earnings. The hot neo-cloud (newer data center operators specializing in GPU-based servers) reported yet another quarter of more than year-over-year doubling in revenue. But talk about wild CapEx-to-revenue figures. Even in a bit of quarterly CapEx moderation, CoreWeave’s ratio dialed in at 1.36 CapEx-to-revenue — an unsustainable amount of spending, to say the least.

That said, this metric for the neo-clouds is also now well known. And as leaders like CoreWeave scale up, this CapEx-to-revenue ratio should (investors ought to expect it should) come down well below 1.0. While there are no guarantees customer backlog will all convert to revenue, and when, the over $55 billion in future contracted revenue — much of which comes from OpenAI and the hyperscalers themselves — is promising CoreWeave can survive the AI data center buildout arms race.

But as a data center operator built specifically for “AI,” CoreWeave will need to prove its GPUs can stay productive as they age, compared to the much larger and much more diverse hyperscaler revenues that believe their GPU servers have useful lives of 5+ years. Time will tell.

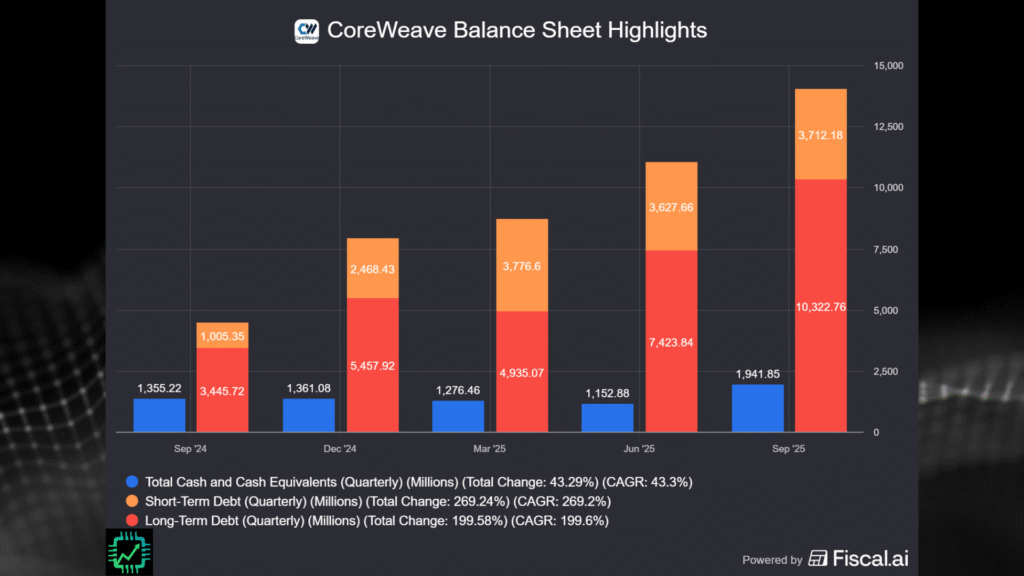

Our issue, though, is that many investors have piled into CoreWeave and the neo-clouds like a collective social media-fueled venture capitalist. CoreWeave, even after a Q3 earnings selloff, has a market cap nearly as high as its future contracted backlog revenue, at over $50 billion. And meanwhile, debt on the balance sheet keeps racking up.

Is it a bubble? Perhaps it is. We aren’t game for comparing this present period to the dot-com era, but we will compare the present AI data center and neo-cloud race to every other hype phase surrounding new tech. Lots of new entrants crowd in, and only a few emerge as future winners — and usually not unscathed, mind you.

Over on Semi Insider, we did a live event walking through some metrics investors can use to gauge the health of capital intensive businesses like the hyperscalers and neo-clouds. See you over there for more!

2 Responses

Wow, those visuals really complement your writing perfectly!

????️ I appreciate how you’ve used imagery to illustrate your points so effectively.

I delight in, lead to I discovered just what I was looking for.

You have ended my four day lengthy hunt! God Bless you man. Have a great

day. Bye